Introducing an All-New Online Banking and Mobile Banking App on February 13, 2024!

We’re excited to bring you new features and more control of your money. Members will experience a simpler, easier-to-use system featuring upgraded security, improved navigation, and a fresh, modern design. Below are important details about the upgrade. If necessary, we will continue to post new information about the upgrade after the go live date. Please continue to visit us frequently for updates.

Is Your LOGON ID less than six characters?

The new online banking and mobile banking system requires Logon IDs with minimum of six characters. If your Logon ID is less than six characters, please call us at 860-643-3420 to establish a new Logon ID.

What’s Not Changing.

Please note there are no changes to your member number, routing number, checks, bill pay, estatements or debit/credit cards. However, you will notice some changes in the way things look and feel on the new online banking and mobile banking app.

What to expect

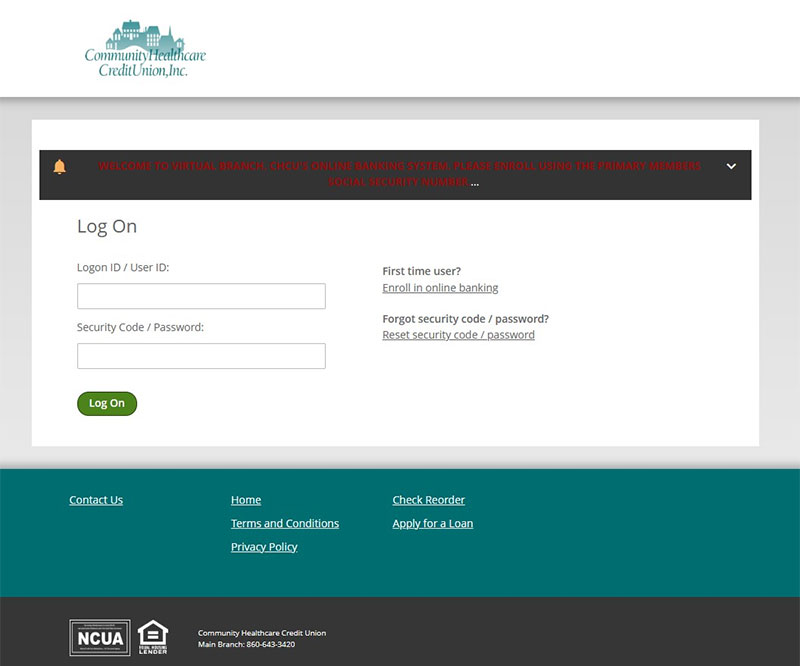

New Online Banking

New URL

On February 13, online banking will be at a new url address. The current Online Banking Login button on our home page will automatically redirect members to the new site on February 13. You may also click on the link below, but it WILL NOT BE LIVE UNTIL February 13. For members who access online banking via a bookmark on their browser, for a time period, the old url will redirect to the new site. Please be sure to bookmark the new site on your browser to avoid interruption.

On February 13, if you’re computer does not display a new online login screen, you may need to clear your cookies.

Logon

If your Login ID is longer than six characters, you may continue to use the same Logon ID and Security Passcode (password) you use in the old app. If your Logon ID is less than six characters, please call us at 860-643-3420 to establish a new Logon ID. You will not be able to access the new digital banking platforms with a Logon ID that is less than six characters.

Upon the first time you log into the new system, members will be required to enter a mobile number and unique email address (if the system does not already have an email on file). You may also be asked to enter the security question answers. Members will be required to re-accept the Terms & Conditions.

New Look/Features

Accounts Tab – new Accounts landing page will display member’s accounts in a tile view with expandable Account Type section like Checking, Savings, Loans, etc.

This tab will also contain shortcuts to view upcoming transfers and recent transactions.

On the new Accounts landing page, links to account details section were added for quick and convenient access. Members will be able to perform actions on same page, without going to a different self-service tab (as it is on old system)

Print History – Members will notice a Print Transaction link when viewing account history. This allows you to save page to the computer or print.

Accounts Preferences – Members have the capability to flag certain accounts as “Favorite” accounts. These accounts will appear as a new group called “Favorites” within the Accounts page. The Accounts Preference screen also allows members to set up account nicknames and to hide/unhide accounts from the Accounts landing page.

Create Alerts – Alerts are a great tool to help monitor your account. Create alerts for withdrawals, deposits, non-sufficient funds, Courtesy Pay and much more. Alerts are delivered via email.

eStatements – Members may view estatements on the new system.

Secure Messages – Members can continue to send secure messages to CHCU staff via the new site.

Check Stop Payment Request – Members can continue to submit a stop payment request on a check. A fee may apply. Refer to our Fee Schedule.

Check Copy Request – Members can continue to request a copy of a check. A fee may apply. Refer to our Fee Schedule.

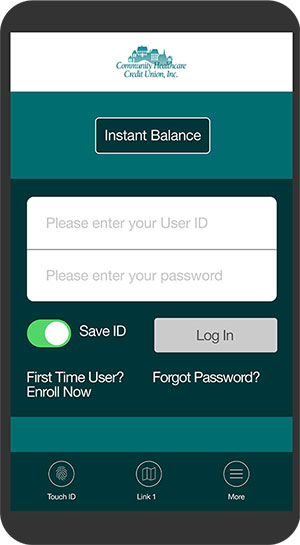

New Mobile Banking App

Members will need to download a new mobile banking app from the Apple App Store or Google Play Store. The new app will be live at 1:00 a.m. ET on February 13, 2014. The old app will be deactivated on February 13 and will not process any transactions after 1:00 a.m. ET on February 13, so be sure to delete it from your device.

To find the new app in the stores, click on link below (the app tile looks the same as old app.) Follow instructions to download the new app to your device and enter your login credentials.

If your Logon ID is less than six characters, please call us at 860-643-3420 to establish a new Logon ID. You will not be able to access the new digital banking platforms with a Logon ID that is less than six characters.

Remote Deposit Capture (Mobile Deposit)

Please note that due to issues with the app integration, remote deposit capture will no longer be available. The functionality will be disabled at 1:00 a.m. ET on February 13, 2024. Any transactions after this time will not be processed.

Please utilize one of these options to deposit your checks:

- Night deposit box located at our branch. It’s on left side of the building.

- In-person at our branch. The branch is open until 6 p.m. on Thursdays.

- USPS mail (for your convenience, we can provide self-addressed, postage-paid envelopes).